Recently, 42 Group was presented with a significant increase in overheads because of an increase in rental costs.

The company’s main overheads are rent, utilities, and office equipment, says managing director Lawrie Jones. Examples of overhead costsĭifferent companies will have different overheads depending on the nature of their industry and company.Ĥ2 Group is a consulting firm that provides writing and marketing services to clients in the scientific and technical communities.

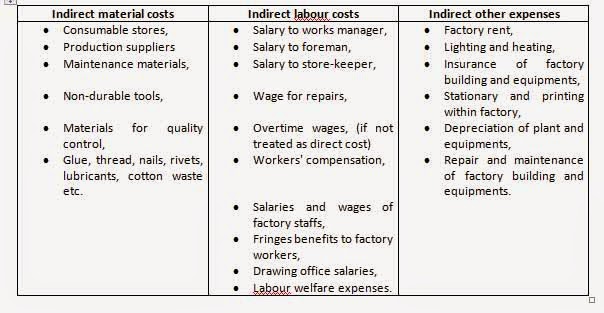

Another example would be if you need to pay for extra cleaning services over and above your standard monthly cost, due to extra work being carried out. For example, a phone plan has a fixed monthly component, but if you exceed the number of calls allowed on your plan, you incur a variable extra cost. Semi-variable costsĪ semi-variable overhead cost usually has a fixed component and a variable component. With rising energy prices, it’s particularly important for companies to monitor and understand their energy overheads. Other variable costs include travel, equipment or vehicle maintenance and energy bills. While staff salaries are a fixed cost, since they must be paid even if the office shuts down, freelance sub-contracted labour is considered a variable cost because it can be removed completely if production stops. Examples include office rental, business insurance, salaries, or accounting services. Fixed costsĪ fixed cost is one that remains steady, regardless of your business activity. There are three main types of overhead: fixed costs, variable costs, and semi-variable costs. What are the different types of overheads? While direct costs relate to expenses that are incurred when delivering a product or service, overhead costs are things your business pays for, regardless of whether you’re delivering one unit, or 100,000 units. Overhead costs are all the costs your business incurs whether or not you are actively producing anything.

OVERHEAD COST EXAMPLES HOW TO

In this article, we will explain how to calculate your overhead costs, and identify potential reductions that could help your bottom line. But in order to reduce overhead costs, you need to understand what they are and how they relate to your business productivity. For most small businesses, reducing overhead costs is a good way to deliver better profit margins.

0 kommentar(er)

0 kommentar(er)